- Market Masters Daily

- Posts

- Why is AAPL Surging with GOOGL News 💡

Why is AAPL Surging with GOOGL News 💡

Get in the Open House

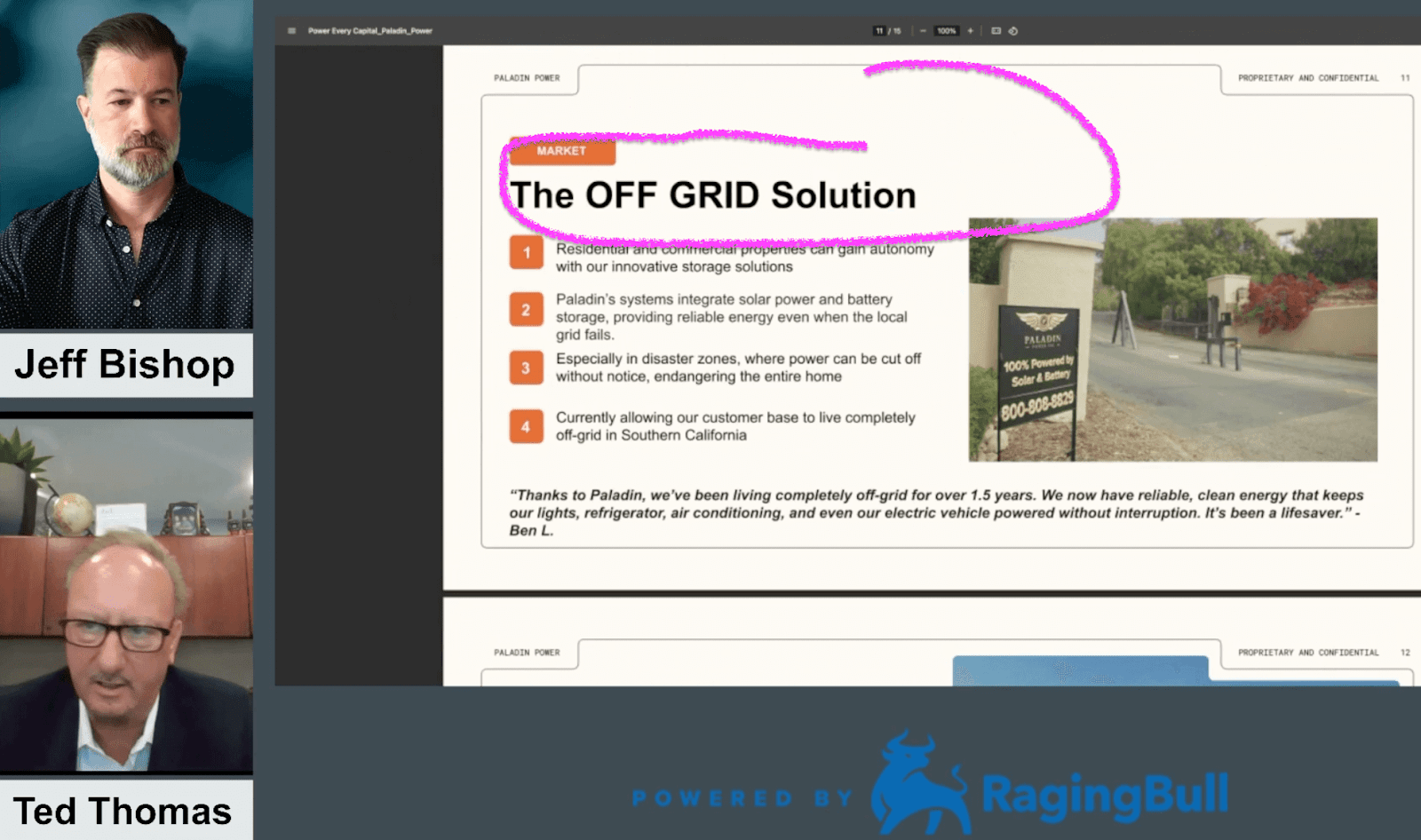

*together with Paladin Power

A.I. vs Energy Storage, which comes first?

Powering the future of AI

My OPEN HOUSE is LIVE right now!

Don’t miss it for live trade alerts, teaching moments and amazing FREE content going live all day this week!

I’ll be trading and teaching about penny stocks, small cap stocks and also options.

Starting at 9am this morning you’ll get my Market Navigator SPY trade of the day. Later in the afternoon you’ll be my hottest penny stock and small cap stock ideas as well, but you NEED to be in the open house room to get them. So don’t miss this opportunity, get going by using the link below.

As I get ready to trade and teach LIVE, I’ll be considering these KEY items not only this morning but this week. Get an edge by reading them now.

Why Apple Stock Is Rising Amid Today’s Google Antitrust Ruling

A U.S. federal court delivered a ruling in the antitrust case against Google (Alphabet)—a decision that’s giving both companies a lift today:

The court rejected the Department of Justice’s push to break up Google, including forcing the sale of Chrome or Android, or banning its lucrative payments to Apple for default search placement on Apple devices.

These default search deals generate over $20 billion annually for Apple, and are extremely high-margin revenue streams. Protecting them avoids a serious blow to Apple’s profits, especially at a time when iPhone growth is sluggish.

Investors see this as a major win: Apple stock is up ~3%, while Alphabet is seeing even sharper gains.

Wedbush analysts went so far as to call the decision a “massive win” for both Apple and Google, underlining the boost to stock outlooks and the ongoing strength of their AI-driven partnership.

The Big Picture: Why This Matters for Apple

Preserving a Key Revenue Stream

Google's continued payments directly benefit Apple’s services segment, which is more profitable than its hardware business. Without that money, Apple’s margins could take a hit just as it needs capital to invest in AI and address other headwinds.Avoiding Disruption at a Critical Time

Apple is grappling with slowdown in iPhone revenue growth and increased geopolitical and competitive pressures. Losing this revenue would have been a major blow amid those challenges.Market Relief from Legal Uncertainty

With this ruling, one significant legal risk has been defused. While the antitrust case continues—and future remedies are possible—the status quo remains intact for now, providing clarity and reassurance to investors.

Bottom Line

Apple’s stock is moving higher because the antitrust ruling safeguards a critical, high-margin revenue stream from Google—its default search payments—at a time when margins matter more than ever. The decision also reduces regulatory overhang and reassures investors that Apple’s cash flows remain relatively stable.

Don’t forget, Wednesday and Thursday I’ll be streaming LIVE just about all day and sharing all my real money trades with you, but you need to be in the chat room so click that link above and let me know when you’re in there that you’re ready to get learning!

So make sure you get your access to OPEN HOUSE by clicking here to submit your email and then checking your inbox for your all access link!

See you there!

Jeff Williams

Where do you see Apple ($AAPL) stock in the next 2–3 years? |

🥂Haven’t joined RB Special Events yet? Change that by subscribing HERE.

Questions or concerns about our products? Call 1-800-380-7072 or Email [email protected] © Copyright 2025, RagingBull.com, LLC

DISCLAIMER: To more fully understand any Ragingbull.com, LLC ("RagingBull") subscription, website, application or other service ("Services"), please review our full disclaimer located at https://ragingbull.com/disclaimer.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, trading results of third parties have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor(IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers mentioned in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

*Sponsored Content: If you purchase anything through a link in this email other than RagingBull (RB) services, you should assume that we have an affiliate relationship with the company providing the product that you purchase, and that we will be paid in some way. RB is not responsible for any content hosted on affiliate’s sites and it is the affiliate’s responsibility to ensure compliance with applicable laws. We recommend that you do your own independent research before purchasing anything. While we believe in the companies we form affiliate relationships with, please don’t spend any money on these products unless you believe they will help you achieve your goals.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.